Due to the fast-growing 4K/8K ultra-HD video applications and the ever increasing use of AR and VR applications, 5G is needed to supplement the capacity of 4G networks.

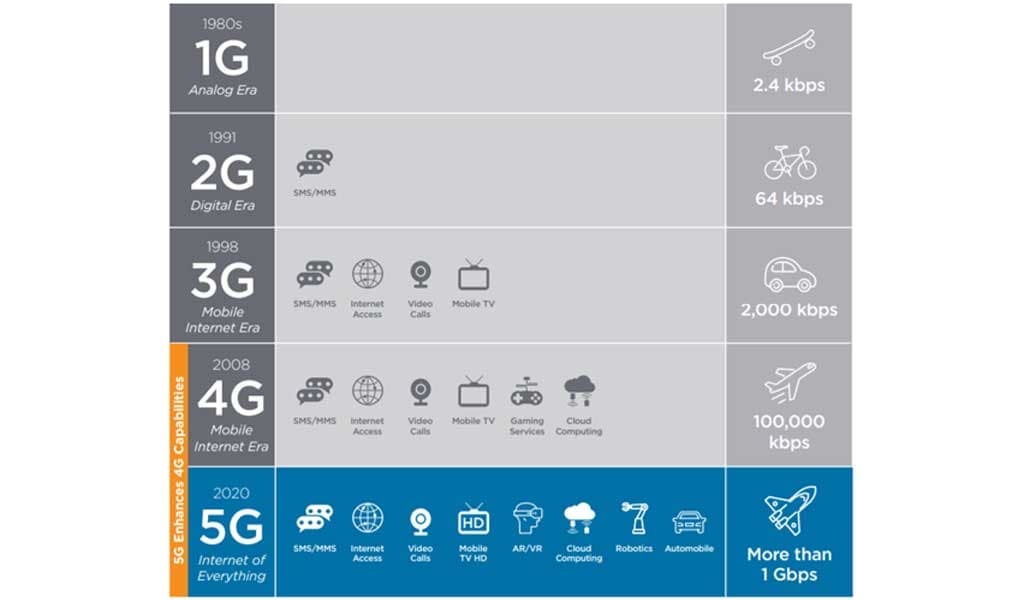

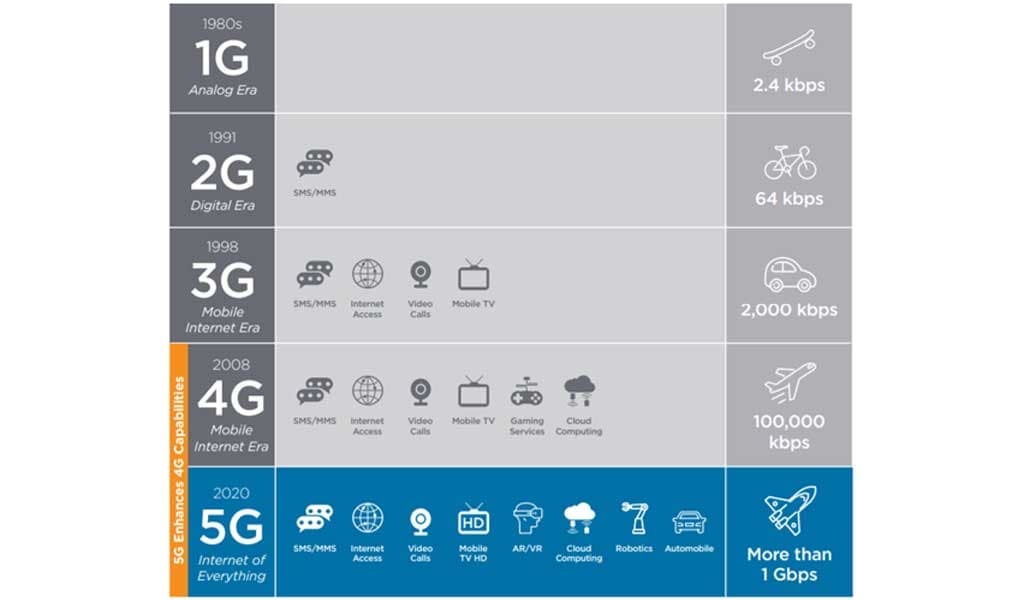

The fifth generation of mobile networks (5G) is about to enable a fully connected world. With the dramatic increase in data rates and amount of connected devices, we will soon be able to enjoy expanded communication between devices (Figure 1) and no longer be limited to userto-user and user-to-device communication. By 2025 an enormous 25 billion devices are expected to be connected under 5G.1

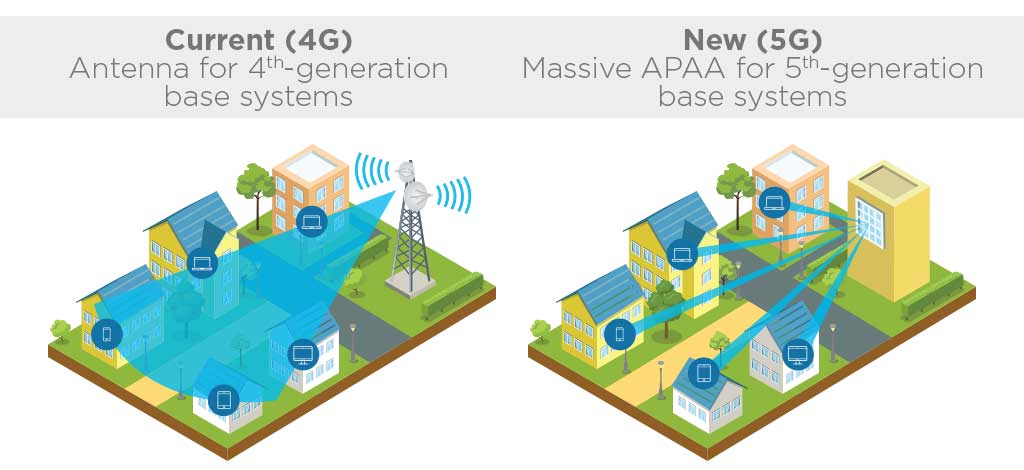

Figure 1. Evolution from 1G to 5G

5G, which can be considered as an overlay to the existing 4G network, represents not only a change to cellular networks but also an integration with communications networks such as Wi-Fi and telemetry (Table 1). According to the Next Generation Mobile Networks (NGMN) Alliance, “5G is an end-to-end ecosystem to enable a fully mobile and connected society. It empowers value creation for customers and partners, through existing and emerging use cases, delivered with consistent experience, and enables sustainable business models.”2 In the near future, we could see major

benefits from embedding 5G connectivity into nearly everything: you can virtually try on clothing and shop at home using virtual reality (VR) headsets; your autonomous vehicle can self-navigate and drive you to your favorite restaurant for dinner; your thermostat can preheat/precool at a desired temperature by retrieving the arrival time of your car as well as current and forecasted weather conditions.

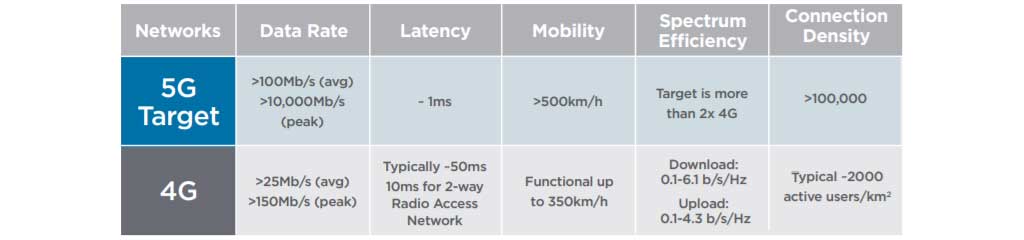

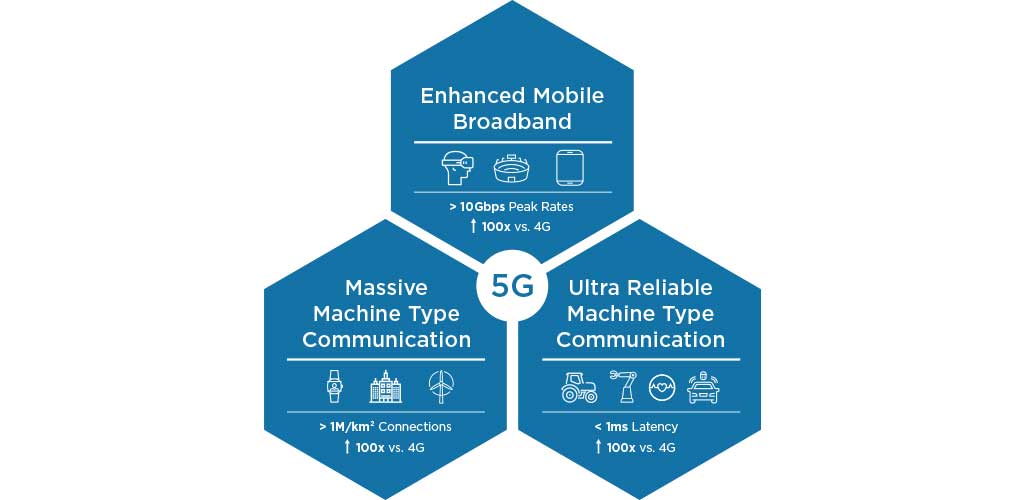

Advanced and reliable connectivity is one of the most critical drivers to enable 5G-powered use cases which can be summarized into three family categories (Figure 2).

Table 1: What 5G can do that 4G not

Possible 5G Enhancements

- Realistic and seamless video streaming

- High definition video downloads in a matter of seconds

- Connected and autonomous driving vehicles

- Connect all your devices and smart home equipment through the IoT ecosystem, enabled by 5G

- Increase in internet-enabled tech - smart traffic lights, wireless sensors, mobile wearables, and car-to-car communication

Figure 2: Three 5G use categories

Mobile Subscribers

The number of unique mobile subscribers is estimated to reach 5.9 billion by 2025, equivalent

to 71% of the world’s population. (© GSMA Intelligence (2018) The Mobile Economy 2018 )

Mobile Data Traffic

Globally, mobile data traffic is expected to increase sevenfold between 2016 and 2021. Mobile

data traffic will grow at a CAGR (Compound Annual Growth Rate) of 46 percent between

2016 and 2021, reaching 48.3 EB (exabyte) per month by 2021. (Cisco Visual Networking Index:

Forecast and Methodology, 2016–2021)

eMBB (Enhanced Mobile Broadband) focuses on providing services that pose high bandwidth requirements, based on user demand for an increasingly digital lifestyle. Typical applications include Virtual Reality (VR) and Augmented Reality (AR), 8K video, and 3D video. eMBB use cases are expected to grow rapidly, led by Asia-Pacific countries, particularly Olympic hosts South Korea and Japan. The recent 2018 Pyeongchang Winter Olympics stands as one of the industry’s first non-test environments of a 5G network. The pilot project contained live or on-demand VR coverage for 30 events, powered by 5G’s ubiquitous coverage across venues, as well as low latency to enable real-time control.

uRLLC (Ultra-Reliable and Low-Latency Communications) aims to cater to the demanding digital industry and focuses on latency-sensitive services. Typical

applications include autonomous vehicles, public and mass transit systems, drones, remote healthcare, smart grid monitoring and control. Latency can also be critical for cloud VR use cases where sub-millisecond latencies will be important to ensure a compelling user experience.

mMTC (massive Machine Type Communications) aims to address demands for a further developed digital society and focuses on services that pose high requirements on connection density as the expansion of the service scope for mobile networks also enriches the telecommunications network. Typical applications include smart cities, industrial automation, and farming.

4K TV sets - By 2021, more than half (56 percent) of connected flat panel TV sets are expected to be 4K, up from 15 percent in 2016. Installed/inservice 4K TV sets will increase from 85M in 2016 to 663M by 2021.3

Virtual Reality and Augmented Reality - traffic is expected to increase 20-fold between 2016 and 2021, at a CAGR of 82 percent.4

Connected Vehicles - By 2020, it is anticipated there will be a quarter billion connected vehicles on the road, enabling new in-vehicle services and automated driving capabilities.5

IoT Connections - The number of Internet of Things (IoT) connections (cellular and non-cellular) is expected to increase more than threefold worldwide between 2017- 2025, reaching 25 billion.6

Mobile Technologies and Services - In 2017, mobile technologies and services generated 4.5% of GDP (Gross Domestic Product) globally, a contribution that amounted to $3.6 trillion of economic value added. By 2022, this contribution is expected to reach $4.6 trillion, or 5% of GDP.7

WAVE TO GREATER CAPACITY

5G is expected to provide an order of magnitude improvement in performance in the areas of greater capacity, lower latency, more mobility, more accuracy of terminal location, increased reliability, and availability. 8 As a critical but scarce resource in the 5G era, spectrum in three key frequency ranges, each with unique features, are expected to deliver widespread coverage and support all 5G use cases: sub-1 GHz, 1-6 GHz and above 6 GHz. The first two are often referenced as sub-6GHz.

This is important as cellular data traffic continues to rise, and eMBB is set to become the core consumer value proposition. We expect both the USA and China to lead the first wave of 5G deployments, with different approaches. China, in our opinion, will focus initial deployments in the C-band (3-5 GHz) targeting IoT use cases. The USA, on the other hand, will focus initial deployments on fixed wireless access through mmWave (above 24 GHz) frequency spectrum as well as deployments in low bands (600 MHz).

In the long run, we believe C-band spectrum may be challenged to deliver enhanced mobile broadband due to limited spectral efficiency and system capacity improvements, as well as less than 10 ms latency. To support the requirements for wide contiguous bandwidths, mmWave bands may need to be considered.

These bands can support large capacity increases for high bandwidth applications. In addition, with techniques like beam forming, wireless signals could be made highly directional without causing much interference, allowing for improved spectral efficiency. However, with increasing carrier frequency, both path loss and diffraction loss become more severe, and the atmospheric effects must be considered.

Currently, there are a large number of preliminary 5G tests worldwide that are using various spectrum bands, particularly 3.5 GHz and 26/28 GHz. In more than 30 regions, there are plans to assign spectrum in two bands over the next two years. (Figure 3).

DESIGNED FOR DIVERSE SPECTRUM BANDS/TYPES

Figure 3: Global snapshot of 5G spectrum bands allocated or targeted (9)

THE EVOLVING ARCHITECTURE

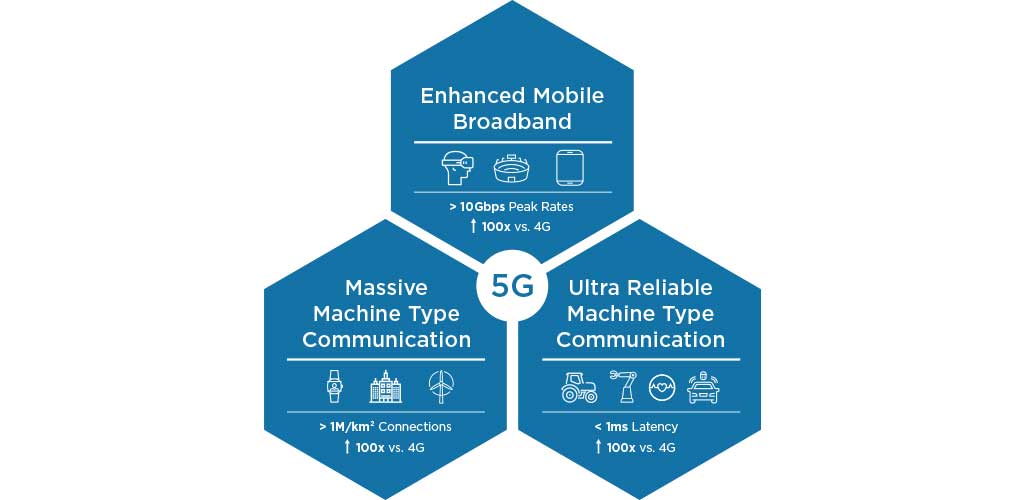

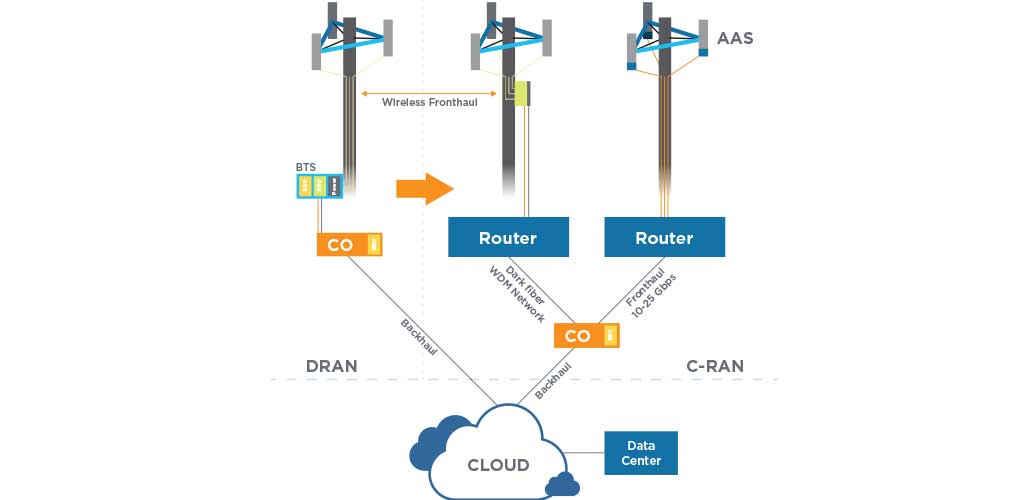

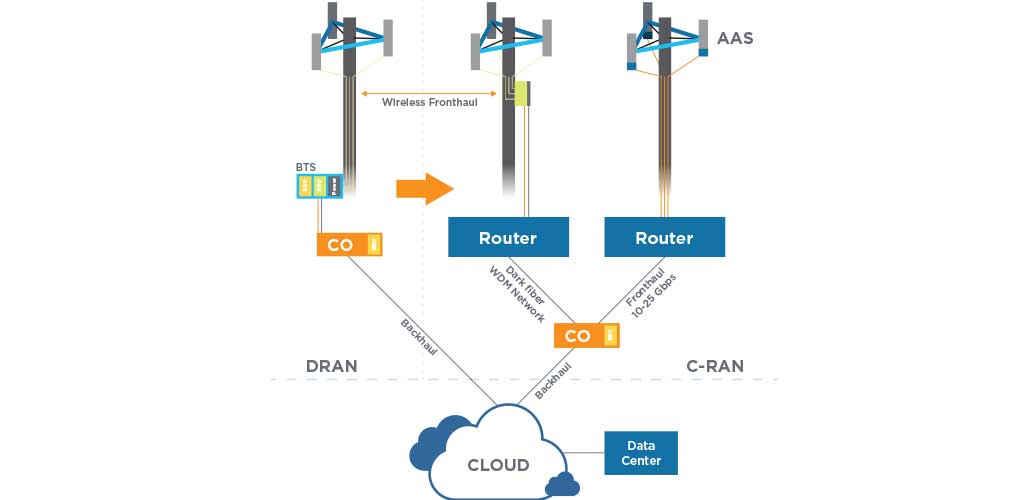

Large amounts of spectrum are required to deliver massive increases in capacity to achieve higher speeds and lower latency. Thus, upgraded architectures and further advances in connection technologies are expected to assist the realization of 5G’s full potential (Figure 4). There are three key architectural shifts that impact 5G connectivity.

Figure 4: The evolving architecture

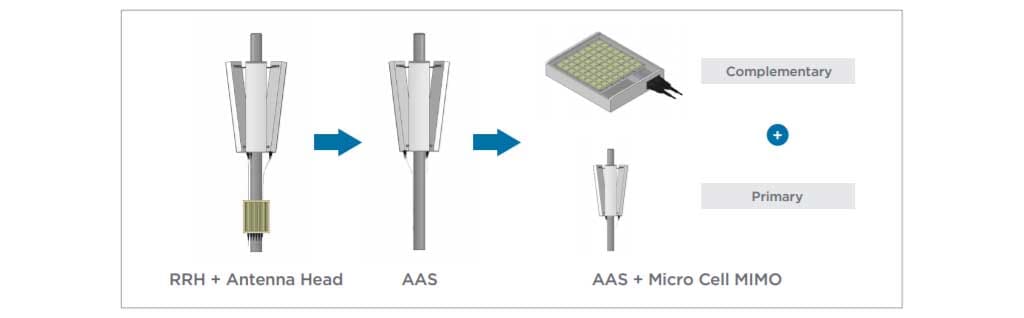

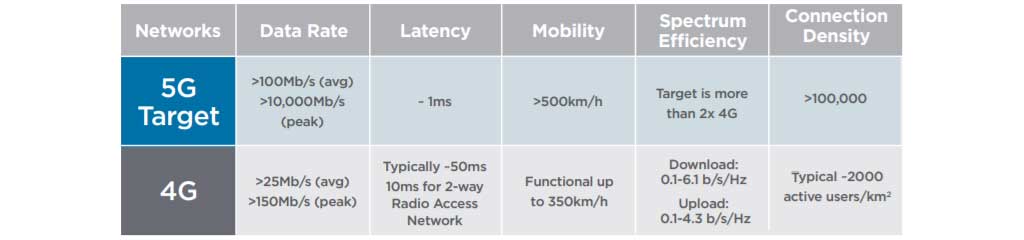

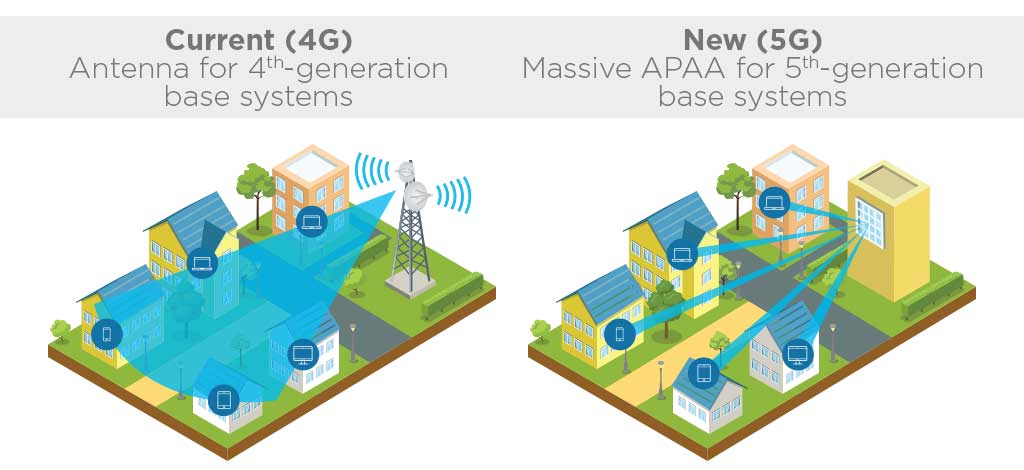

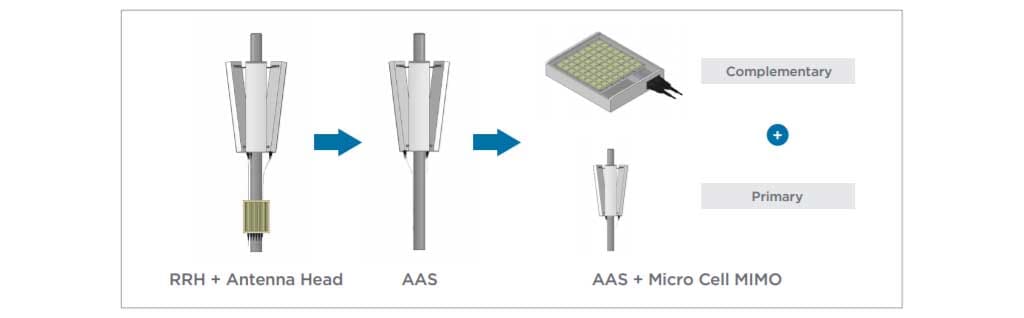

1. Adoption of Massive Minimuminput Minimum-output (MIMO) active antenna systems (AAS). The 5G ecosystem is expected to support high-density networks by adding new features to the radios and to the overall system layout. The traditional combination in 3G/4G networks of a remote radio head connected to an external antenna will be extended by active antenna systems (AAS) or active phased-array antennas with massive antenna elements (massive APAA’s) (Figure 5), in which the electronics will be embedded in the antenna system and operating over a wide frequency range (600 MHz to 28 GHz and above) GHz. This primary system will be supported by complementary systems in dense areas (Figure 6). These complementary systems will have a high number of antennas to support multi-user MIMO (MU-MIMO). These antenna elements will feature their own control electronics, requiring new connectivity solutions. Frequencies above 6 GHz will be predominately supported by highly integrated systems. These radio frequency integrated circuits (RFIC) often feature integrated antennas on the top surface of the chipset.

5G massive active antenna systems are anticipated to increase system complexity, require greater miniaturization of antennas and greater integration of antennas with filters and power amplifiers. Being a provider of customized embedded antenna solutions, TE offers a wide array of customized antennas solutions that could accommodate the mechanical constraints of your application and design and manufacture antennas that comply with the most stringent of operating requirements. Additionally, TE’s high-speed input/output (I/O), internal connector and cabling solutions, cost-effective RF coax solutions and antenna modules are all well suited for the next generation of antenna systems.

Figure 5: Current 4G compared to new 5G (10)

Figure 6: Evolution from remote radio head and antenna to primary and complementary systems.

2. Adoption of New Transmission Technology in Fronthaul. 5G will bring very high capacity. For that reason, the fronthaul to the base band unit (BBU), backhaul and transport network will likely need to be upgraded to support increasing traffic requirements. We expect to see greater high-speed optical connectivity in the overall network, with TE’s high-speed I/O portfolio, including SFP28, QSFP28, and FullAXS connectors as possible high-speed and dense connectivity solutions. Small cells will be a key component in the 5G era. They will increase the density of the network and bring short-range solutions, potentially utilizing both sub-6 GHz and mmWave technology. For sub-6 GHz deployments, TE has an extensive portfolio of antennas and products that protect against electromagnetic interference (EMI). Deeper fiber penetration (closer to the small cell location) may also be required to backhaul traffic from small cells leveraging our highspeed product portfolio.

3. The Adoption C-RAN. In 5G networks, we expect to see greater utilization of cloud-like concepts applied to both the

radio access network and core network. C-RAN (Cloud RAN) will focus on both centralizing BBUs and the adoption of cloud technologies like virtualization. The centralization phase is all about mobbing the BBU to a common location that serves multiple towers, which largely reduces the cost of land, power, cooling and operational expenses. The cloud phase virtualizes hardware-based BBUs allowing them to run on commercial off-the-shelf servers. BBU pooling as well as the adoption of cloud technologies – SDN (Software-Defined Network), NFV (Network Functions Virtualization), network slicing and virtualization—will all still require high-speed, high-data, high-density, and reliable and rugged connectivity solutions.

TE’s connectivity solutions, which are useful for base station and optical transport, push the boundaries of speed and bandwidth within today’s architectures and address challenging data rates, signal and power requirements of emerging 5G mobile networks. In addition to our antenna expertise, our high-speed board-to-board and cabled solutions offer increased bandwidth for backplanes and mid-planes. We can leverage our expertise in data center and cloud technology to provide high-speed I/O solutions, high-speed cabled solutions, high-speed board-to-board solutions and power solutions.

Amid the backdrop of debate and unknown ramifications to the industry at large, the mobile industry is expected to reach numerous milestones leading up to the year 2025, including major progress in 5G with commercial launches anticipated to take place in the United States in 2018 and in major markets in Asia, North America, and Europe over the next three years11 (Table 2). The official approval of non-standalone 5G new radio (NSA 5G NR) specifications in December 2017, as well as the commercial debut of 5G at the 2018 Pyeongchang Winter Olympics both define the desire for a 5G-powered future.

5G took center stage at Mobile World Congress (MWC) 2018 as an exciting and imminent new technology. The leading equipment manufactures all announced dozens of innovative products: Huawei unveiled its first commercial 5G customer premises equipment (CPE), a terminal device supporting 3GPP 5G standards with a Huawei-developed Balong 5G01 chipset, as part of its end-to-end 5G solution; Ericsson showcased super low latency of 5G (just 6 milliseconds); Intel showcased the first 5G-enabled 2-in-1 concept PC; Samsung announced that its complete commercial fixed-wireless access (FWA) 5G solution has become the first globally to receive approval by the United States Federal Communications Commission (FCC).

Table 2:

5G operator rollout plans - timing, spectrum, scope

| Country | Operator | 5G Rollout Status |

|---|---|---|

| China | China Mobile | End of 2018: 5G field tests; pre-commercial 2019; commercial service in 2020 |

| China Unicorn | 2020: 5G commercial launch but gradual uptake; to co-exist with 4G for a long time | |

| China Telecom | 2017-2018: outdoor 5G trial; commercial trial in 2019, scale rollout in 2020 to co-exist with 4G for a while | |

| Korea | KT | 2018: pilot tests in 28 GHz during Winter Olympics; commercial service intended in 3.5 GHz and 28 GHz |

| Japan | NTT | 2018: 5G rollout to commence. Has nationwide FTTH network; no spectrum auction in Japan – allocated by Govt. for free |

| Softbank | 2017: Trials ongoing in 4 / 4.5 GHz / 28 GHz in Tokyo; commercial launch planned for 2020 | |

| USA | Verizon | 2018: FWA trials in 11 cities; commercial 5G FWA deployments in 2018 using mmWave in 28 GHz, 39 GHz |

| AT&T | Late-2018: could launch standards-based 5G network | |

| T-Mobile | 2019: 5G deployments to commence in 600 MHz aimed at IoT; full nationwide coverage in 2020 | |

| Sprint | Late 2019: 5G launch in 2.5 GHz | |

| Europe | Multiple Carriers | By 2020: European Regulator pushing for one urban 5G market in each country with rollouts in 3.5 GHz initially. Carriers reserved about 5G plans.By 2020: European Regulator pushing for one urban 5G market in each country with rollouts in 3.5 GHz initially. Carriers reserved about 5G plans. |

| Russia | MTS | 2018: Gearing up for 2018 FIFA World Cup and expanding LTE network for increased capacity. 5G will be rolled out in targeted areas but will not have same coverage as LTE. |

Get Ready Now

5G will achieve faster transmission rates, more powerful data exchange networks and more seamless real-time communication which will boost tremendous growth for advanced and innovative connectivity solutions. TE is the go-to, one stop solutions provider for all of your connectivity needs. As a committed innovator, TE enables our partners to capitalize on opportunities in the 5G era with our global footprint, broad product portfolio and deep-rooted local engineering expertise.

1 © GSMA Intelligence (2018) - The Mobile Economy 2017

2 © GSMA Intelligence (2014) - Understanding 5G: Perspectives on future technological advancements in mobile, December 2014.

3 Cisco Visual Networking Index Predicts Global Annual IP Traffic to Exceed Three Zettabytes by 2021

4 Cisco Visual Networking Index Predicts Global Annual IP Traffic to Exceed Three Zettabytes by 2021

5 https://www.gartner.com/newsroom/id/2970017

6 © GSMA Intelligence (2018) - The Mobile Economy 2018

7 © GSMA Intelligence (2018) - The Mobile Economy 2018

8 The 5G Infrastructure Public Private Partnership (5G PPP): 5G Vision

9 Qualcomm Technologies, Inc.

10 Mitsubishi Electric Corporation, “Mitsubishi Electric’s New Multibeam Multiplexing 5G Technology Achieves 20Gbps Throughput”, No. 2984, Tokyo, January 21, 2016

11 The Mobile Economy 2018

Due to the fast-growing 4K/8K ultra-HD video applications and the ever increasing use of AR and VR applications, 5G is needed to supplement the capacity of 4G networks.

The fifth generation of mobile networks (5G) is about to enable a fully connected world. With the dramatic increase in data rates and amount of connected devices, we will soon be able to enjoy expanded communication between devices (Figure 1) and no longer be limited to userto-user and user-to-device communication. By 2025 an enormous 25 billion devices are expected to be connected under 5G.1

Figure 1. Evolution from 1G to 5G

5G, which can be considered as an overlay to the existing 4G network, represents not only a change to cellular networks but also an integration with communications networks such as Wi-Fi and telemetry (Table 1). According to the Next Generation Mobile Networks (NGMN) Alliance, “5G is an end-to-end ecosystem to enable a fully mobile and connected society. It empowers value creation for customers and partners, through existing and emerging use cases, delivered with consistent experience, and enables sustainable business models.”2 In the near future, we could see major

benefits from embedding 5G connectivity into nearly everything: you can virtually try on clothing and shop at home using virtual reality (VR) headsets; your autonomous vehicle can self-navigate and drive you to your favorite restaurant for dinner; your thermostat can preheat/precool at a desired temperature by retrieving the arrival time of your car as well as current and forecasted weather conditions.

Advanced and reliable connectivity is one of the most critical drivers to enable 5G-powered use cases which can be summarized into three family categories (Figure 2).

Table 1: What 5G can do that 4G not

Possible 5G Enhancements

- Realistic and seamless video streaming

- High definition video downloads in a matter of seconds

- Connected and autonomous driving vehicles

- Connect all your devices and smart home equipment through the IoT ecosystem, enabled by 5G

- Increase in internet-enabled tech - smart traffic lights, wireless sensors, mobile wearables, and car-to-car communication

Figure 2: Three 5G use categories

Mobile Subscribers

The number of unique mobile subscribers is estimated to reach 5.9 billion by 2025, equivalent

to 71% of the world’s population. (© GSMA Intelligence (2018) The Mobile Economy 2018 )

Mobile Data Traffic

Globally, mobile data traffic is expected to increase sevenfold between 2016 and 2021. Mobile

data traffic will grow at a CAGR (Compound Annual Growth Rate) of 46 percent between

2016 and 2021, reaching 48.3 EB (exabyte) per month by 2021. (Cisco Visual Networking Index:

Forecast and Methodology, 2016–2021)

eMBB (Enhanced Mobile Broadband) focuses on providing services that pose high bandwidth requirements, based on user demand for an increasingly digital lifestyle. Typical applications include Virtual Reality (VR) and Augmented Reality (AR), 8K video, and 3D video. eMBB use cases are expected to grow rapidly, led by Asia-Pacific countries, particularly Olympic hosts South Korea and Japan. The recent 2018 Pyeongchang Winter Olympics stands as one of the industry’s first non-test environments of a 5G network. The pilot project contained live or on-demand VR coverage for 30 events, powered by 5G’s ubiquitous coverage across venues, as well as low latency to enable real-time control.

uRLLC (Ultra-Reliable and Low-Latency Communications) aims to cater to the demanding digital industry and focuses on latency-sensitive services. Typical

applications include autonomous vehicles, public and mass transit systems, drones, remote healthcare, smart grid monitoring and control. Latency can also be critical for cloud VR use cases where sub-millisecond latencies will be important to ensure a compelling user experience.

mMTC (massive Machine Type Communications) aims to address demands for a further developed digital society and focuses on services that pose high requirements on connection density as the expansion of the service scope for mobile networks also enriches the telecommunications network. Typical applications include smart cities, industrial automation, and farming.

4K TV sets - By 2021, more than half (56 percent) of connected flat panel TV sets are expected to be 4K, up from 15 percent in 2016. Installed/inservice 4K TV sets will increase from 85M in 2016 to 663M by 2021.3

Virtual Reality and Augmented Reality - traffic is expected to increase 20-fold between 2016 and 2021, at a CAGR of 82 percent.4

Connected Vehicles - By 2020, it is anticipated there will be a quarter billion connected vehicles on the road, enabling new in-vehicle services and automated driving capabilities.5

IoT Connections - The number of Internet of Things (IoT) connections (cellular and non-cellular) is expected to increase more than threefold worldwide between 2017- 2025, reaching 25 billion.6

Mobile Technologies and Services - In 2017, mobile technologies and services generated 4.5% of GDP (Gross Domestic Product) globally, a contribution that amounted to $3.6 trillion of economic value added. By 2022, this contribution is expected to reach $4.6 trillion, or 5% of GDP.7

WAVE TO GREATER CAPACITY

5G is expected to provide an order of magnitude improvement in performance in the areas of greater capacity, lower latency, more mobility, more accuracy of terminal location, increased reliability, and availability. 8 As a critical but scarce resource in the 5G era, spectrum in three key frequency ranges, each with unique features, are expected to deliver widespread coverage and support all 5G use cases: sub-1 GHz, 1-6 GHz and above 6 GHz. The first two are often referenced as sub-6GHz.

This is important as cellular data traffic continues to rise, and eMBB is set to become the core consumer value proposition. We expect both the USA and China to lead the first wave of 5G deployments, with different approaches. China, in our opinion, will focus initial deployments in the C-band (3-5 GHz) targeting IoT use cases. The USA, on the other hand, will focus initial deployments on fixed wireless access through mmWave (above 24 GHz) frequency spectrum as well as deployments in low bands (600 MHz).

In the long run, we believe C-band spectrum may be challenged to deliver enhanced mobile broadband due to limited spectral efficiency and system capacity improvements, as well as less than 10 ms latency. To support the requirements for wide contiguous bandwidths, mmWave bands may need to be considered.

These bands can support large capacity increases for high bandwidth applications. In addition, with techniques like beam forming, wireless signals could be made highly directional without causing much interference, allowing for improved spectral efficiency. However, with increasing carrier frequency, both path loss and diffraction loss become more severe, and the atmospheric effects must be considered.

Currently, there are a large number of preliminary 5G tests worldwide that are using various spectrum bands, particularly 3.5 GHz and 26/28 GHz. In more than 30 regions, there are plans to assign spectrum in two bands over the next two years. (Figure 3).

DESIGNED FOR DIVERSE SPECTRUM BANDS/TYPES

Figure 3: Global snapshot of 5G spectrum bands allocated or targeted (9)

THE EVOLVING ARCHITECTURE

Large amounts of spectrum are required to deliver massive increases in capacity to achieve higher speeds and lower latency. Thus, upgraded architectures and further advances in connection technologies are expected to assist the realization of 5G’s full potential (Figure 4). There are three key architectural shifts that impact 5G connectivity.

Figure 4: The evolving architecture

1. Adoption of Massive Minimuminput Minimum-output (MIMO) active antenna systems (AAS). The 5G ecosystem is expected to support high-density networks by adding new features to the radios and to the overall system layout. The traditional combination in 3G/4G networks of a remote radio head connected to an external antenna will be extended by active antenna systems (AAS) or active phased-array antennas with massive antenna elements (massive APAA’s) (Figure 5), in which the electronics will be embedded in the antenna system and operating over a wide frequency range (600 MHz to 28 GHz and above) GHz. This primary system will be supported by complementary systems in dense areas (Figure 6). These complementary systems will have a high number of antennas to support multi-user MIMO (MU-MIMO). These antenna elements will feature their own control electronics, requiring new connectivity solutions. Frequencies above 6 GHz will be predominately supported by highly integrated systems. These radio frequency integrated circuits (RFIC) often feature integrated antennas on the top surface of the chipset.

5G massive active antenna systems are anticipated to increase system complexity, require greater miniaturization of antennas and greater integration of antennas with filters and power amplifiers. Being a provider of customized embedded antenna solutions, TE offers a wide array of customized antennas solutions that could accommodate the mechanical constraints of your application and design and manufacture antennas that comply with the most stringent of operating requirements. Additionally, TE’s high-speed input/output (I/O), internal connector and cabling solutions, cost-effective RF coax solutions and antenna modules are all well suited for the next generation of antenna systems.

Figure 5: Current 4G compared to new 5G (10)

Figure 6: Evolution from remote radio head and antenna to primary and complementary systems.

2. Adoption of New Transmission Technology in Fronthaul. 5G will bring very high capacity. For that reason, the fronthaul to the base band unit (BBU), backhaul and transport network will likely need to be upgraded to support increasing traffic requirements. We expect to see greater high-speed optical connectivity in the overall network, with TE’s high-speed I/O portfolio, including SFP28, QSFP28, and FullAXS connectors as possible high-speed and dense connectivity solutions. Small cells will be a key component in the 5G era. They will increase the density of the network and bring short-range solutions, potentially utilizing both sub-6 GHz and mmWave technology. For sub-6 GHz deployments, TE has an extensive portfolio of antennas and products that protect against electromagnetic interference (EMI). Deeper fiber penetration (closer to the small cell location) may also be required to backhaul traffic from small cells leveraging our highspeed product portfolio.

3. The Adoption C-RAN. In 5G networks, we expect to see greater utilization of cloud-like concepts applied to both the

radio access network and core network. C-RAN (Cloud RAN) will focus on both centralizing BBUs and the adoption of cloud technologies like virtualization. The centralization phase is all about mobbing the BBU to a common location that serves multiple towers, which largely reduces the cost of land, power, cooling and operational expenses. The cloud phase virtualizes hardware-based BBUs allowing them to run on commercial off-the-shelf servers. BBU pooling as well as the adoption of cloud technologies – SDN (Software-Defined Network), NFV (Network Functions Virtualization), network slicing and virtualization—will all still require high-speed, high-data, high-density, and reliable and rugged connectivity solutions.

TE’s connectivity solutions, which are useful for base station and optical transport, push the boundaries of speed and bandwidth within today’s architectures and address challenging data rates, signal and power requirements of emerging 5G mobile networks. In addition to our antenna expertise, our high-speed board-to-board and cabled solutions offer increased bandwidth for backplanes and mid-planes. We can leverage our expertise in data center and cloud technology to provide high-speed I/O solutions, high-speed cabled solutions, high-speed board-to-board solutions and power solutions.

Amid the backdrop of debate and unknown ramifications to the industry at large, the mobile industry is expected to reach numerous milestones leading up to the year 2025, including major progress in 5G with commercial launches anticipated to take place in the United States in 2018 and in major markets in Asia, North America, and Europe over the next three years11 (Table 2). The official approval of non-standalone 5G new radio (NSA 5G NR) specifications in December 2017, as well as the commercial debut of 5G at the 2018 Pyeongchang Winter Olympics both define the desire for a 5G-powered future.

5G took center stage at Mobile World Congress (MWC) 2018 as an exciting and imminent new technology. The leading equipment manufactures all announced dozens of innovative products: Huawei unveiled its first commercial 5G customer premises equipment (CPE), a terminal device supporting 3GPP 5G standards with a Huawei-developed Balong 5G01 chipset, as part of its end-to-end 5G solution; Ericsson showcased super low latency of 5G (just 6 milliseconds); Intel showcased the first 5G-enabled 2-in-1 concept PC; Samsung announced that its complete commercial fixed-wireless access (FWA) 5G solution has become the first globally to receive approval by the United States Federal Communications Commission (FCC).

Table 2:

5G operator rollout plans - timing, spectrum, scope

| Country | Operator | 5G Rollout Status |

|---|---|---|

| China | China Mobile | End of 2018: 5G field tests; pre-commercial 2019; commercial service in 2020 |

| China Unicorn | 2020: 5G commercial launch but gradual uptake; to co-exist with 4G for a long time | |

| China Telecom | 2017-2018: outdoor 5G trial; commercial trial in 2019, scale rollout in 2020 to co-exist with 4G for a while | |

| Korea | KT | 2018: pilot tests in 28 GHz during Winter Olympics; commercial service intended in 3.5 GHz and 28 GHz |

| Japan | NTT | 2018: 5G rollout to commence. Has nationwide FTTH network; no spectrum auction in Japan – allocated by Govt. for free |

| Softbank | 2017: Trials ongoing in 4 / 4.5 GHz / 28 GHz in Tokyo; commercial launch planned for 2020 | |

| USA | Verizon | 2018: FWA trials in 11 cities; commercial 5G FWA deployments in 2018 using mmWave in 28 GHz, 39 GHz |

| AT&T | Late-2018: could launch standards-based 5G network | |

| T-Mobile | 2019: 5G deployments to commence in 600 MHz aimed at IoT; full nationwide coverage in 2020 | |

| Sprint | Late 2019: 5G launch in 2.5 GHz | |

| Europe | Multiple Carriers | By 2020: European Regulator pushing for one urban 5G market in each country with rollouts in 3.5 GHz initially. Carriers reserved about 5G plans.By 2020: European Regulator pushing for one urban 5G market in each country with rollouts in 3.5 GHz initially. Carriers reserved about 5G plans. |

| Russia | MTS | 2018: Gearing up for 2018 FIFA World Cup and expanding LTE network for increased capacity. 5G will be rolled out in targeted areas but will not have same coverage as LTE. |

Get Ready Now

5G will achieve faster transmission rates, more powerful data exchange networks and more seamless real-time communication which will boost tremendous growth for advanced and innovative connectivity solutions. TE is the go-to, one stop solutions provider for all of your connectivity needs. As a committed innovator, TE enables our partners to capitalize on opportunities in the 5G era with our global footprint, broad product portfolio and deep-rooted local engineering expertise.

1 © GSMA Intelligence (2018) - The Mobile Economy 2017

2 © GSMA Intelligence (2014) - Understanding 5G: Perspectives on future technological advancements in mobile, December 2014.

3 Cisco Visual Networking Index Predicts Global Annual IP Traffic to Exceed Three Zettabytes by 2021

4 Cisco Visual Networking Index Predicts Global Annual IP Traffic to Exceed Three Zettabytes by 2021

5 https://www.gartner.com/newsroom/id/2970017

6 © GSMA Intelligence (2018) - The Mobile Economy 2018

7 © GSMA Intelligence (2018) - The Mobile Economy 2018

8 The 5G Infrastructure Public Private Partnership (5G PPP): 5G Vision

9 Qualcomm Technologies, Inc.

10 Mitsubishi Electric Corporation, “Mitsubishi Electric’s New Multibeam Multiplexing 5G Technology Achieves 20Gbps Throughput”, No. 2984, Tokyo, January 21, 2016

11 The Mobile Economy 2018